FINANCIAL NEWS

The Market In Numbers – 7 Feb 2026

Overviews in raw numbers and calculations that might assist investors with assessing trends and currents that might not be apparent from daily volatility and movements

Feb 07 2026

ASX Winners And Losers Of Today – 06-02-26

The table inside ranks the 20 biggest percentage winners and losers among stocks in the ASX300 at the end of each trading day

Feb 06 2026

Next Week At A Glance – 9-13 Feb 2026

A brief look at important company events and economic data releases next week

Feb 06 2026

FNArena Corporate Results Monitor – 06-02-2026

FNArena’s Monitor keeps track of corporate earnings result releases, including broker views, ratings and target price changes and beat/miss assessments

Feb 06 2026

Weekly Top Ten News Stories – 6 February 2026

Our top ten news stories from 29 January 2026 to 05 February 2026

Feb 06 2026

UBS rates ASX as Neutral

A second upgrade in target price for ASX by UBS this week, and the fourth this year. This time, the target is lifted to $57.60 from $56.90, and Neutral is maintained.

The latest trigger is a continuation of strong trading momentum into early 2H26, the broker highlights, with January showing outsized growth across cash equities and futures. It points to potential near-term upside to consensus revenue and EPS, in the broker's view.

Upside beyond 2H26 is, however, seen as limited given rising cost risks into FY27, potential clearing and settlement fee resets in FY28, and valuation pressure across global exchanges amid AI disruption concerns.

EPS forecast for 2H26 lifted for 2H26, with the broker's FY26 forecast now 2% ahead of consensus. FY27 EPS estimate raised by 0.8%.

Citi rates BPT as Sell

Beach Energy reported a solid 1H26 earnings beat, with underlying EBITDA of $558m, beating consensus by 7%, Citi highlights.

Core net profit was ahead by 22%, driven by lower operating costs and higher other income, partly offset by higher tariffs and tolls.

Exploration spend was again taken below the line, while one-off Waitsia ramp-up costs were higher than guided, the broker explains. FY26 production and capex guidance remains unchanged.

A key disappointment was the dividend, which at 1c was below the broker's and consensus estimate of 2c, and the broker now expects a refreshed capital management framework in August.

FY26 EPS forecast trimmed by -5% and FY27 by -4% following revised treatment of tolls and tariffs. Citi retains a Sell rating and $1 target price.

Macquarie rates NXT as Outperform

Macquarie points to Singtel and KKR’s acquisition of a 100% stake in ST Telemedia Global Data Centres (STT GDC) for an enterprise value (adjusted for committed capex and minorities) of $15.496bn, which is a premium of 35% to NextDC's valuation.

Comparing the valuations, the analyst highlights STT GDC sold at around 20x adjusted EV/contracted earnings (EBITDA) against NextDC trading at 14.8x currently.

STT GDC operates 50 data centres with 673MW of operating capacity across Europe, India, SE Asia and North Asia. Comparatively, it operates more in the cloud space and most customers are global hyperscalers and blue chip companies.

Macquarie retains an Outperform rating and $22.30 target price. No change to the broker's earnings forecasts.

Click here to see full report

ANALYSIS & DATA

FNARENA'S MARKET CONSENSUS FORECASTS

To display the stock analysis for a company please enter the company code:

ANZ | ANZ GROUP HOLDINGS LIMITED

Abbreviated format - see the full version here

| LAST PRICE | CHANGE +/- | CHANGE % | VOLUME |

|---|---|---|---|

$37.58 05 Feb |

OPEN $37.00 |

HIGH $37.68 | 4,548,983 LOW $36.93 |

| TARGET | |||

| $35.028-6.8% downside | |||

| Franking for last dividend paid out: 70% |

| Title | FY24 Actual | FY25 Actual | FY26 Forecast | FY27 Forecast |

|---|---|---|---|---|

| EPS (cps) | xxx | 198.2 | 244.0 | xxx |

| DPS (cps) | xxx | 166.0 | 167.2 | xxx |

| EPS Growth | xxx | - 9.1% | 23.1% | xxx |

| DPS Growth | xxx | 0.0% | 0.7% | xxx |

| PE Ratio | xxx | N/A | 15.2 | xxx |

| Dividend Yield | xxx | N/A | 4.5% | xxx |

| Div Pay Ratio(%) | xxx | 83.8% | 68.5% | xxx |

FOLLOW US ON SOCIAL MEDIA

DAILY FINANCIAL NEWS

The Market In Numbers – 7 Feb 2026

Overviews in raw numbers and calculations that might assist investors with assessing trends and currents that might not be apparent from daily volatility and movements

Feb 07 2026 - Australia

FNArena’s Monitor keeps track of corporate earnings result releases, including broker views, ratings and target price changes and beat/miss assessments

Feb 06 2026 - Australia

FNArena’s Monitor keeps track of corporate earnings result releases, including broker views, ratings and target price changes and beat/miss assessments

Feb 05 2026 - Australia

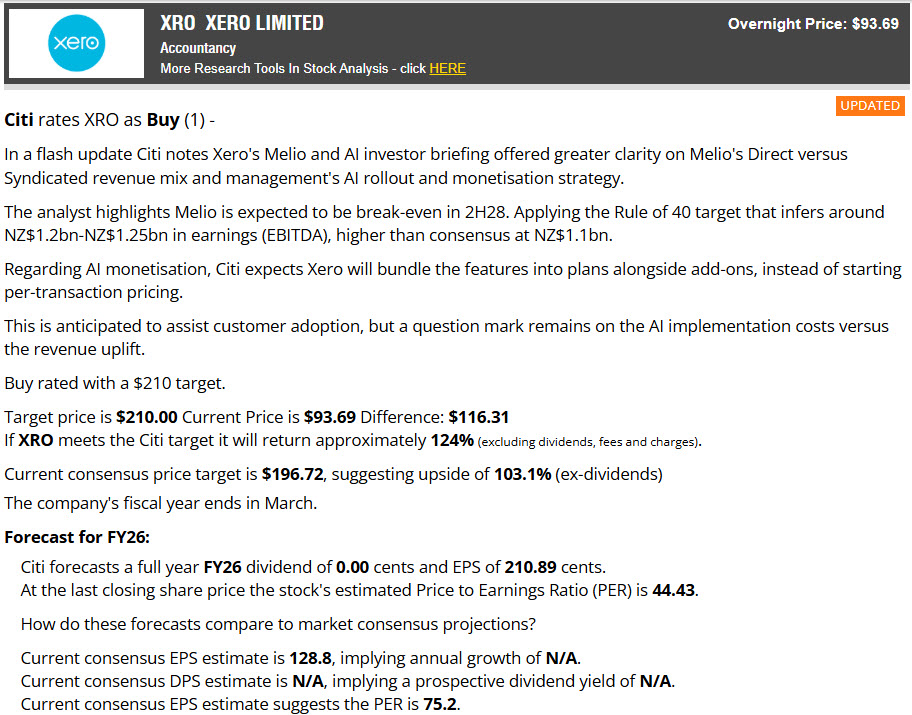

Xero’s latest presentation addressed central concerns around AI monetisation, disruption and a stronger growth outlook for recently acquired Melio, but markets globally are in the grip of collective AI disruption angst

Feb 05 2026 - Australia

FNArena’s Monitor keeps track of corporate earnings result releases, including broker views, ratings and target price changes and beat/miss assessments

Feb 04 2026 - Australia

A blow-off top in gold’s parabolic rally is unsurprising. Analysts suggest the drivers of the rally to date are unchanged, and a sell-off provides opportunities in Australian gold miners

Feb 04 2026 - Commodities

PR NEWSWIRE

Delonix Bioworks Announces IND Clearance for DX-104, a Novel Engineered MenB OMV Vaccine Candidate, in China and Australia

Feb 06 2026 - PR NewsWire

Cowbell Launches in Australia, Bringing AI-Powered Cyber Protection backed by the Financial Strength of Zurich

Feb 06 2026 - PR NewsWire

Providence Therapeutics Announces Appointment of Leah Goodman to the Board of Directors

Feb 06 2026 - PR NewsWire

Global Mind Australia and Farmacist enter strategic partnership to advance precision, sustainable agriculture from Australia to ASEAN

Feb 05 2026 - PR NewsWire

Sigenergy C&I Inverters Gain CEC Listing in Australia

Feb 05 2026 - PR NewsWire

Silicon Quantum Computing Launches Quantum Twins™ Enabling the Simulation of Quantum Physics and Chemistry

Feb 05 2026 - PR NewsWire

RUDI'S VIEWS

Rudi’s View: Woolies, CSL, Macquarie (& More)

Updates on Conviction Calls, Best Buys and most favoured sector picks for the February results season

Feb 05 2026

DAILY MARKET REPORTS

ASX Winners And Losers Of Today – 06-02-26

The table inside ranks the 20 biggest percentage winners and losers among stocks in the ASX300 at the end of each trading day

Feb 06 2026

Today’s Financial Calendar – 06-02-2026

Significant Scheduled Events For 06 February, 2026

Feb 06 2026

ASX Winners And Losers Of Today – 05-02-26

The table inside ranks the 20 biggest percentage winners and losers among stocks in the ASX300 at the end of each trading day

Feb 05 2026

Australian Broker Call *Extra* Edition – Feb 05, 2026

Extra Edition of the Broker Call Report

Feb 05 2026

Today’s Financial Calendar – 05-02-2026

Significant Scheduled Events For 05 February, 2026

Feb 05 2026

WEEKLY REPORTS

Next Week At A Glance – 9-13 Feb 2026

A brief look at important company events and economic data releases next week

Feb 06 2026

Weekly Top Ten News Stories – 6 February 2026

Our top ten news stories from 29 January 2026 to 05 February 2026

Feb 06 2026

In Case You Missed It – BC Extra Upgrades & Downgrades – 06-02-26

A summary of the highlights from Broker Call Extra updates throughout the week past

Feb 06 2026

In Brief: Credit Corp, Horizon Minerals & Artrya

Small and mid cap stocks highlight how earnings timing, operational transitions and regulatory catalysts are shaping valuation inflection points

Feb 06 2026

The Short Report – 05 Feb 2026

FNArena’s weekly update on short positions in the Australian share market

Feb 05 2026

Uranium Week: Back Above US$100lb

Sprott capital raising results in a U308 spot market buying spree, taking local uranium stocks along for the ride

Feb 03 2026

Weekly Update On LICs & LITs – 03-Feb-2026

Weekly update of Listed Investment Companies (LICs) & Listed Investment Trusts (LITs) on the ASX

Feb 03 2026

Australian Listed Real Estate Tables – 02-02-2026

FNArena provides a weekly update of Australian listed real estate trusts (REIT) and property developers, current pricing yield and valuation data

Feb 02 2026

Weekly Ratings, Targets, Forecast Changes – 30-01-26

Weekly update on stockbroker recommendation, target price, and earnings forecast changes

Feb 02 2026

THE MARKETS

Click item/line to change chart

FNARENA WINDOWS

Window on ACCOUNTANCY

Is AI Nemesis Or Opportunity For Xero?

Xero’s latest presentation addressed central concerns around AI monetisation, disruption and a stronger growth outlook for recently acquired Melio, but markets globally are in the grip of collective AI disruption angst

Feb 05 2026

Window on GOLD & SILVER

Why Gold Beats Bitcoin & ASX Opportunities

A blow-off top in gold’s parabolic rally is unsurprising. Analysts suggest the drivers of the rally to date are unchanged, and a sell-off provides opportunities in Australian gold miners

Feb 04 2026

Window on URANIUM

Uranium Week: Back Above US$100lb

Sprott capital raising results in a U308 spot market buying spree, taking local uranium stocks along for the ride

Feb 03 2026

GEN AI

Is AI Nemesis Or Opportunity For Xero?

Xero’s latest presentation addressed central concerns around AI monetisation, disruption and a stronger growth outlook for recently acquired Melio, but markets globally are in the grip of collective AI disruption angst

Feb 05 2026

0.510

0.510