PR NewsWire | Oct 17 2024

|

SYDNEY, Oct. 16, 2024 /PRNewswire/ –

HIGHLIGHTS

Cohort 4 – SECuRE Trial

- The third participant of cohort 4 (multi-dose) of the SECuRE trial1 has now completed the Dose Limiting Toxicity (DLT) period after a second dose of 12GBq of 67Cu-SAR-bisPSMA, following on from the announcement dated 12 September 20242.

- The patient is a 93-year-old with a history of prostate cancer of over 26 years who previously failed multiple lines of therapy. No DLTs were reported after 2 doses of 12GBq of 67Cu-SAR-bisPSMA. The only adverse event (AE) the patient experienced was moderate nausea after the first dose, which resolved.

- The safety profile of multiple doses of 67Cu-SAR-bisPSMA remains favourable. Almost all AEs related to 67Cu-SAR-bisPSMA in cohort 4 were mild to moderate, with the majority having either resolved or improved at the last assessment.

- No DLTs have been observed in the SECuRE trial to date in any of the cohorts.

- Preliminary efficacy assessment from cohort 4 showed that all 3 participants had reductions in prostate-specific antigen (PSA) levels following 2 doses of 12GBq of 67Cu-SAR-bisPSMA, with the largest drop being 95.7% to date.

- The remaining 3 slots in cohort 4 have now been allocated, and 2 participants have received their first cycle of 12GBq of 67Cu-SAR-bisPSMA. The final participant has commenced screening activities and is planned to receive his first therapy cycle in the coming weeks.

Expanded Access Program (EAP) update: Multi-dose 67Cu-SAR-bisPSMA

- Complete response with 2 doses of 8GBq of 67Cu-SAR-bisPSMA

- A patient who had failed several lines of therapy and achieved a complete response following 2 doses of 8GBq of 67Cu-SAR-bisPSMA (first dose through the SECuRE trial and second dose through the EAP) remains with undetectable PSA for almost 13 months.

- Durable response with multiple doses of 67Cu-SAR-bisPSMA

- A patient from cohort 1 who had a reduction in PSA of 94.4% following the administration of 4 doses of 4GBq of 67Cu-SAR-bisPSMA (first dose through the SECuRE trial and 3 doses under the EAP) has received an additional dose (8GBq) following a recent rise in PSA.

- This fifth dose of 67Cu-SAR-bisPSMA was administered approximately 14 months after the previous dose and over 2 years after the first dose. It has already resulted in a 47.5% reduction in PSA (vs. the latest peak in PSA value of 10.1 ng/mL).

- These case studies highlight the positive outcomes for patients with metastatic castration-resistant prostate cancer (mCRPC) undergoing adaptive dosing using 67Cu-SAR-bisPSMA, in which a treatment break is introduced following remarkable responses to therapy, demonstrating the potential of flexible dosing regimens with this product.

- This data is being used to guide Clarity’s future development of 67Cu-SAR-bisPSMA.

Clarity Pharmaceuticals (ASX: CU6) ("Clarity"), a clinical stage radiopharmaceutical company with a mission to develop next-generation products that improve treatment outcomes for children and adults with cancer, is pleased to share a number of updates on the 67Cu-SAR-bisPSMA program.

Cohort 4 – SECuRE Trial

Cohort 4 is anticipated to be the final cohort in the dose escalation phase of the SECuRE study (pending final safety assessment by the Safety Review Committee [SRC]), with participants receiving a minimum of 2 and a maximum of 4 doses of 67Cu-SAR-bisPSMA at 12GBq.

The SRC has completed the review of the safety data of the third participant in cohort 4 who received 2 doses of 67Cu-SAR-bisPSMA. The safety profile of multiple doses of 12GBq of 67Cu-SAR-bisPSMA remains favourable, confirming the preliminary safety findings of previous cohorts (single-dose cohorts, 1, 2 and 3). Almost all AEs in the 3 participants in cohort 4 were mild to moderate, with the majority having resolved or improved at the last assessment. No DLTs have been observed in any participants across all cohorts in the SECuRE trial to date.

The third participant, who recently completed his DLT period, is a 93-year-old patient with a long history of prostate cancer (diagnosed over 26 years ago, stage IIIB). He had failed several lines of therapy (e.g. androgen deprivation therapy [ADT] and 2 androgen pathway receptor inhibitors [ARPIs]) prior to entering the SECuRE trial. The participant only experienced 1 AE (Grade 2 nausea) during the trial, which followed the first cycle of 67Cu-SAR-bisPSMA (12GBq). This nausea resolved in just over a week from the time it was first reported.

Early preliminary efficacy assessment showed a reduction in PSA levels following 2 treatment cycles in all 3 participants in cohort 4, with 2 patients already showing PSA reductions >50% vs. baseline. The last patient’s PSA peaked at 32.7 ng/mL and has so far dropped to 20.2 ng/mL. The largest drop in PSA in cohort 4 to date is a decline of 95.7% (from a baseline of 157.4 ng/mL), and it remains in a downward trend based on the latest assessment. This participant, who had failed multiple lines of therapy prior to receiving 67Cu-SAR-bisPSMA (e.g. ADT, ARPI and an investigational agent), has already had a radiographic partial response based on Response Evaluation Criteria in Solid Tumours v1.1 (RECIST) assessment, with a reduction of 60.6% in tumour volume thus far, evaluated by prostate-specific membrane antigen (PSMA) positron emission tomography (PET) imaging with 64Cu-SAR-bisPSMA.

The 3 remaining slots in cohort 4 have been allocated. Two participants have been enrolled and have received their first cycle of 67Cu-SAR-bisPSMA. Both patients continue in follow-up. The final participant is being planned for his first therapy cycle in the coming weeks, pending the outcome of ongoing screening assessments. Cohort 4 will be followed by a cohort expansion phase of the trial (Phase II) in 14 participants, pending safety evaluation.

EAP: Multiple doses of 67Cu-SAR-bisPSMA

Complete response with 2 doses of 8GBq of 67Cu-SAR-bisPSMA

The first patient to receive 2 doses of 67Cu-SAR-bisPSMA at 8GBq (first dose through the SECuRE trial and second dose under the U.S. Food and Drug Administration [FDA] EAP) had been heavily pre-treated (e.g. chemotherapy, ADT, 2 ARPIs and an investigational agent). 67Cu-SAR-bisPSMA treatment led to a complete anatomical, molecular and biochemical response (assessed by RECIST criteria, PET and PSA, respectively)3. The patient’s latest follow up on 14 October 2024 showed that he remains with undetectable PSA for almost 13 months, having received his first dose of 67Cu-SAR-bisPSMA over 17 months ago (June 2023). Most AEs related to 67Cu-SAR-bisPSMA were mild to moderate, with the majority having either improved or resolved over time.

Durable response with multiple doses of 67Cu-SAR-bisPSMA

One of the participants from cohort 1 who initially received the lowest dose in the SECuRE trial of 67Cu-SAR-bisPSMA (4GBq) in October 2022, went on to receive 3 additional cycles under the EAP (4GBq each). The patient had failed several lines of treatment prior to receiving 67Cu-SAR-bisPSMA (i.e. ADT and 2 ARPIs). A reduction greater than 50% in PSA levels was observed in this patient following the first administration of 67Cu-SAR-bisPSMA and a drop of 94% in PSA was observed after the fourth cycle4.

A recent 64Cu-SAR-bisPSMA PET scan performed in July 2024 showed a reduction in tumour volume vs. baseline (41.6%), despite the patient not having received any 67Cu-SAR-bisPSMA for approximately 14 months since his last dose in June 2023 (Figure 1).

![Figure 1. Images show considerable reduction in lesion uptake (64Cu-SAR-bisPSMA PET) following 4 doses of 67Cu-SAR-bisPSMA (4GBq each; PET conducted in July 2024, approximately 14 months post-fourth cycle). Reduction in uptake (maximum standardised uptake value [SUVmax]) and tumour volume: 72.5% and 41.6%, respectively. New bone lesions identified (red circles) in the most recent image prior to the fifth dose. The fifth dose was delivered on 30 July 2024, with PSA having fallen 47.5% as of 24 September 2024 and trending downward. Post-treatment scans are pending. Figure 1. Images show considerable reduction in lesion uptake (64Cu-SAR-bisPSMA PET) following 4 doses of 67Cu-SAR-bisPSMA (4GBq each; PET conducted in July 2024, approximately 14 months post-fourth cycle). Reduction in uptake (maximum standardised uptake value [SUVmax]) and tumour volume: 72.5% and 41.6%, respectively. New bone lesions identified (red circles) in the most recent image prior to the fifth dose. The fifth dose was delivered on 30 July 2024, with PSA having fallen 47.5% as of 24 September 2024 and trending downward. Post-treatment scans are pending.](https://mma.prnasia.com/media2/2531886/Images_show_considerable_reduction_lesion_uptake__64Cu_SAR_bisPSMA_PET__4_doses.jpg?p=medium600)

Figure 1. Images show considerable reduction in lesion uptake (64Cu-SAR-bisPSMA PET) following 4 doses of 67Cu-SAR-bisPSMA (4GBq each; PET conducted in July 2024, approximately 14 months post-fourth cycle). Reduction in uptake (maximum standardised uptake value [SUVmax]) and tumour volume: 72.5% and 41.6%, respectively. New bone lesions identified (red circles) in the most recent image prior to the fifth dose. The fifth dose was delivered on 30 July 2024, with PSA having fallen 47.5% as of 24 September 2024 and trending downward. Post-treatment scans are pending.

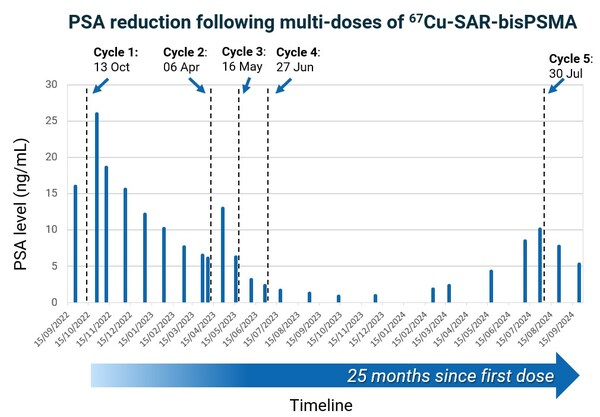

Most recently, this patient’s clinician requested an additional dose of 8GBq of 67Cu-SAR-bisPSMA under the EAP following rising PSA levels. In the weeks following the administration of the fifth dose, a reduction in PSA of 47.5% was observed (vs. the most recent PSA peak value of 10.1 ng/mL), with the PSA continuing to decline at the last assessment (Figure 2). This patient continues to derive clinical benefit approximately 25 months after receiving his first dose of 67Cu-SAR-bisPSMA. The only reported AE in this patient related to the fifth dose of 8GBq of 67Cu-SAR-bisPSMA was mild thrombocytopenia (Grade 1), which is improving. No other related AEs were reported for this patient following the first 4 doses at 4GBq.

Figure 2. PSA reduction following multiple doses of 67Cu-SAR-bisPSMA. Reduction of 94.4% observed in October 2023 following 4 cycles of 67Cu-SAR-bisPSMA (4GBq each). A recent rise in PSA led to the administration of a fifth cycle of 67Cu-SAR-bisPSMA (8GBq), resulting in a PSA reduction of 47.5% (vs. most recent peak of PSA value of 10.1 ng/mL). The PSA continues to decline based on the last assessment.

Clarity’s Executive Chairperson, Dr Alan Taylor, commented, "We continue to be very impressed by the data generated with our proprietary molecule, SAR-bisPSMA. Recently we announced that we have received the U.S. FDA Fast-Track Designation (FTD) for the use of this molecule in the pre-prostatectomy setting, coupled with copper-64 for imaging. This week we provided our shareholders with feedback from the FDA in relation to our second Phase III clinical trial in BCR of prostate cancer with the same molecule for imaging. We plan to commence recruitment into this trial, AMPLIFY, early next year given the data demonstrating that we are able to pick up lesions far earlier and far smaller than other PSMA imaging agents. And now we are continuing to share very compelling safety and efficacy data with the use of the same molecule, coupled with copper-67 for therapy, even in patients in their 90s who have had cancer for over a quarter of a century. This means that every patient through the entirety of the prostate cancer journey may benefit from this extraordinary molecule when it is coupled with the perfect pairing of copper isotopes. All of these individual indications, being imaging in pre-prostatectomy and BCR patients, as well as therapy, are blockbuster markets individually for PSMA-targeted products, with an estimated combined market value of approximately US$10-15 billion by 2030.

"What truly sets Clarity apart from the competition in this space, is that we know the functionality of the first-generation monomer-based PSMA-targeted products in the market and constructed our new proprietary SAR bisPSMA molecule to overcome the issues of uptake and retention of these products in lesions. We have then completed head-to-head studies, pre-clinically and clinically, and consistently shown that SAR-bisPSMA exhibits 2 to 3 times the amount of uptake in lesions and is retained there over time. When we couple this advantage with the use of the perfect pairing of copper isotopes, we are uniquely placed and very excited about our opportunity to change the treatment paradigm for patients from first diagnosis to last option. These patients are desperately in need of better diagnosis and treatment than what is offered with the first-generation PSMA agents currently in market and other prostate cancer diagnostics and therapies in development.

"This has been a phenomenal feat for Australian science, and preliminary safety and efficacy assessments suggest the potential of this proprietary molecule to become a best-in-class diagnostic and treatment for men with prostate cancer. With regards to therapy, we are seeing excellent responses in patients who have been heavily pre-treated prior to receiving 67Cu-SAR-bisPSMA, with little to no options left for treatment of their disease. Moreover, this response appears to be durable, with some patients experiencing the maximum effect from the treatment months to years after being administered with 67Cu-SAR-bisPSMA, based on the data from the previous cohorts of the SECuRE trial and the EAP. Importantly, although cohorts 1 to 3 were single dose cohorts, the 2 case studies of patients treated with additional cycles of 67Cu-SAR-bisPSMA under the EAP highlight the potential of adaptive dosing using our product. Early and durable responses may allow patients to have a treatment holiday, delaying additional cycles to be administered at later time-points. This approach may not only help to minimise toxicities compared to continuous dosing schedules, but it could also prolong the duration of responses. Administration of doses with fixed intervals is a well-recognised challenge in radioligand therapy for mCRPC patients, and this preliminary data shows the potential for how personalised regimens with 67Cu-SAR-bisPSMA could improve patient outcomes.

"We look forward to completing cohort 4, with all 3 remaining slots now allocated, and are utilising the data collected to date to inform the next stages of our clinical development program, including cohort expansion in the SECuRE trial and a subsequent Phase III trial. Given the favourable safety profile of 67Cu-SAR-bisPSMA, we are planning to progress its development not only in late-stage patients who have failed multiple lines of therapy, but also in earlier stages of metastatic prostate cancer. Our team, our research collaborators at the University of Melbourne, clinical collaborators, Key Opinion Leaders and Clinical Advisers are all very excited about what the future holds for this promising product and we are working tirelessly to bring it to people who need it most in a timely manner, whilst adhering to the highest standards of clinical research."

About the SECuRE trial

The SECuRE trial (NCT04868604)1 is a Phase I/IIa theranostic trial for identification and treatment of participants with PSMA-expressing mCRPC using 64Cu/67Cu-SAR-bisPSMA. 64Cu-SAR-bisPSMA is used to visualise PSMA-expressing lesions and select candidates for subsequent 67Cu-SAR-bisPSMA therapy. The trial is a multi-centre, single arm, dose escalation study with a cohort expansion involving approximately 44 participants in the U.S. and Australia. The overall aim of the trial is to determine the safety and efficacy of 67Cu-SAR-bisPSMA for the treatment of prostate cancer.

About Cohort 4 of the SECuRE Trial

Cohort 4 is designed as a "3+3" cohort, where participants will receive a minimum of 2 therapy cycles. Based on the positive safety profile observed in the first 3 cohorts of the SECuRE trial, a change to the dosing schedule of cohort 4 from "2 doses" to "up to 4 doses" has been implemented. This will allow participants who are benefiting from 67Cu-SAR-bisPSMA to receive 2 additional doses under the SECuRE trial (up to 4 doses in total).

About SAR-bisPSMA

SAR-bisPSMA derives its name from the word "bis", which reflects a novel approach of connecting two PSMA-targeting agents to Clarity’s proprietary sarcophagine (SAR) technology that securely holds copper isotopes inside a cage-like structure, called a chelator. Unlike other commercially available chelators, the SAR technology prevents copper leakage into the body. SAR-bisPSMA is a TCT that can be used with isotopes of copper-64 (Cu-64 or 64Cu) for imaging and copper-67 (Cu-67 or 67Cu) for therapy.

64Cu-SAR-bisPSMA and 67Cu-SAR-bisPSMA are unregistered products. Individual results may not represent the overall safety and efficacy of the products. The data outlined in this announcement has not been assessed by health authorities such as the U.S. FDA. A clinical development program is currently underway to assess the efficacy and safety of these products. There is no guarantee that these products will become commercially available.

About Prostate Cancer

Prostate cancer is the second most common cancer diagnosed in men globally and the fifth leading cause of cancer death in men worldwide5. Prostate cancer is the second-leading causes of cancer death in American men. The American Cancer Institute estimates in 2024 there will be 299,310 new cases of prostate cancer in the U.S. and around 35,250 deaths from the disease6.

About Clarity Pharmaceuticals

Clarity is a clinical stage radiopharmaceutical company focused on the treatment of serious disease. The Company is a leader in innovative radiopharmaceuticals, developing targeted copper theranostics based on its SAR Technology Platform for the treatment of cancer in children and adults.

www.claritypharmaceuticals.com

References

- ClinicalTrials.gov Identifier: NCT04868604, https://clinicaltrials.gov/ct2/show/NCT04868604

- Clarity Pharmaceuticals: SECuRE trial advances: No dose limiting toxicities and strong preliminary efficacy data in first multi-dose cohort, https://www.claritypharmaceuticals.com/news/c4_update/

- Clarity Pharmaceuticals: Clarity update: Complete response in first patient ever treated with 2 doses of Cu-67 SAR-bisPSMA at 8GBq, https://www.claritypharmaceuticals.com/news/complete_response/

- Clarity Pharmaceuticals: Clarity’s theranostic prostate cancer trial advances to highest dose level, https://www.claritypharmaceuticals.com/news/secure_cohort3/

- Global Cancer Statistics 2022: GLOBOCAN Estimates of Incidence and Mortality Worldwide for 36 Cancers in 185 Countries, https://acsjournals.onlinelibrary.wiley.com/doi/10.3322/caac.21834

- American Cancer Society: Key Statistics for Prostate Cancer, https://www.cancer.org/cancer/prostate-cancer/about/key-statistics.html

For more information, please contact:

| Clarity Pharmaceuticals | |

| Dr Alan Taylor | Catherine Strong |

| Executive Chairman | Investor/Media Relations |

| +61 406 759 268 |

This announcement has been authorised for release by the Executive Chairperson.