Commodities | Jul 12 2007

By Greg Peel

Around about this time last year, the crude oil price passed through US$75/bbl (West Texas Intermediate). There were several reasons for oil reaching such a high price.

Firstly, emerging markets such as China and India were demanding more oil to drive production, and more oil to drive cars. Secondly, OPEC was maintaining, or at least attempting to maintain tight production quotas in order to benefit from the higher price. Thirdly, questions were being raised over whether all the large and economically viable global sources had already been tapped, and whether or not they had passed their “peak”. Fourthly, global weather patterns continued to be unstable, suggesting the possibility of another round of Gulf hurricanes ahead. Fifthly, leftist Venezuelan leader Hugo Chavez was in the process of cutting back on oil exports to the US. Sixthly, terrorist activity in Nigeria was disrupting supply. Seventhly, tensions between Iran and the US were threatening to remove a large chunk of the supply pipeline and eighthly, Israel and Lebanon were at war.

Had you been in a coma for twelve months, the only thing you might say on your return to consciousness is: Oh, have Israel and Lebanon stopped fighting?

A cessation of hostilities in the Middle East quickly wiped a geopolitical premium off the overbought oil price and traders were happy to overlook everything else as the market endured the big commodity price correction. A Katrina-less US fall also helped in pushing the oil price down to below US$50/bbl. Some misguided fools even called for a return to US$30/bbl.

So it’s basically taken a year for the market to recognise that, outside of Lebanon, nothing ever actually changed. And if the US was to begin pulling out of Iraq (which it won’t while Bush holds the veto) that region would no doubt see a secular territorial land grab as the Sunnis and Shi-ites face off, which suggests Middle Eastern turmoil is just as much with us anyway. That oil should be heading back towards US$75/bbl is really no great shock.

The oil price rally has accelerated in the last week or so, fuelled by a report from the International Energy Agency that beyond 2010 global supply will not be able to keep up with global demand. Not that this would have come as a huge shock to everyone involved. But in truth, there is one rather important difference between the oil price exceeding US$70/bbl in 2006 and the oil price exceeding US$70/bbl in 2007.

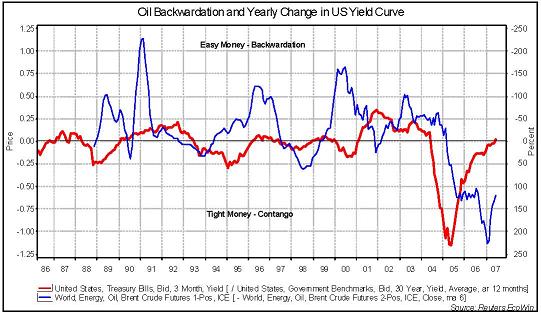

The difference is that global interest rates have begun to normalise. For the past couple of years the yield curve has been inverted (90-day rates above bond rates) as the world has been raising the cash rate due to strong economic growth and inflation fears while bond rates remained stubbornly low. Now, however, the curve has been flattening out and threatening to return to normal. In the US, for example, it has taken the Fed seventeen moves to get cash rates to 5.25% but only last month did the bond rate catch up.

As the consultants at GaveKal point out, this has a material effect on the oil market, and what better proxy is there for the global economy than the oil curve?

Except that the oil curve works upside down. For the last two years or so, the oil market has been in contango. A contango occurs when the oil contracts in the future are priced higher than spot. The natural conclusion from this is that the market believes the oil price will be higher in the future. But what it actually means is that the cost of funding to store oil is less than the cost of storing oil. In other words, if interest rates are lesser out to time then it pays to hang onto the oil now rather than selling it all straightaway.

While storing up oil might conjure images of drums and warehouses, the most obvious way to “store” oil is to leave it where it is – in the ground. As long as the value of that oil is not being eroded over time (ie there is an inverted yield curve) then it pays to withhold supply and ensure an ongoing high price. And the less oil apparently available now means a higher spot price.

But if the yield curve were to normalise then the value of oil stored would be less than the value of oil sold today. To that end, as the yield curve has begun to flatten so too has the oil curve flattened, and indeed flipped into backwardation. So strong has been the desire to store oil, notes GaveKal, that the world ran out of places to store it. New tanks have been built. Now that we have moved into backwardation, it’s time to empty those tanks.

How will that affect the spot price?

The important thing to remember is that anything might happen. As the US looks to turn the screws further on Iran by restricting access to global capital markets, Iran may yet (as was always feared this time last year) cease supplying its own oil to the West or, worse still, blockade the Persian Gulf from which a vast chunk of the world’s oil is transported. While this would not necessarily be a great move for Iran (it has no refineries and imports petrol from the US) it would certainly hit Americans right where it hurts – in the gas tank. This scenario last year was not only eliciting calls of oil above US$100/bbl, but even US$200/bbl.

Then of course as the world seems to suffer an endless round of wild weather – from heat waves to floods – there’s no reason not to believe that Katrina and friends were just taking a break last season and will be back refreshed come August.

And there could be any number of other shock factors but all things being equal (including ongoing emerging market demand), it is quite possible that the oil price is getting ready to tip over. Stored oil will likely start leaving the tanks, GaveKal suggests, and it is the speculators, not the suppliers, who are holding the long contracts out into time.