Commodities | Feb 25 2009

By Andrew Nelson

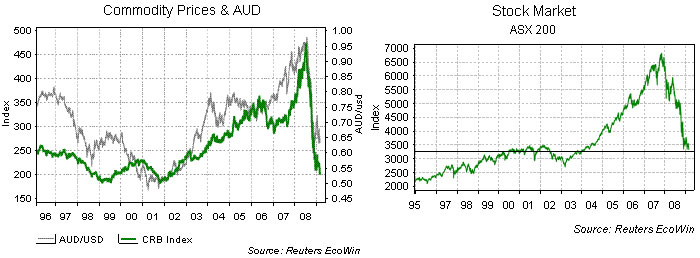

Pardon me for stating the obvious, but commodity prices are still facing hard times. This is best evidenced by the state of the CRB index of commodity prices, which has now fallen to its lowest level since June 2002 and is a massive 58% below its zenith of July 2008. If we lived in the US, Europe, or Japan, this might not be such horrible news, as cheap commodities equal easing price pressures, but Australia is a commodity economy.

Six months ago you would have been labelled mad for predicting that the rise and rise of commodity prices must at some point correct itself, especially given the looming impact of the credit crisis. Back in August, our esteemed editor dared to voice just such a prediction, calling an end to the commodities supercycle and it wasn’t well received by everyone. To put it mildly.

It all started when the credit crisis hit and it became obvious that with collapsing banks and gridlocked credit, economies worldwide were going to suffer. This, as we all know by now, highlighted the fact that most major economies were already nearing recessionary levels and a global recession would soon follow.

With producers going at it hammer and tong until it became blatantly obvious that there would be little market for their produce, capacity very quickly exceeded demand. Add to the mix a frantic unwinding of speculative positions, and the bottom quickly fell out of commodities prices. What started as a little trickle in August turned into a flood by September, a flood that still has our markets awash.

With producer capacities only being cut over the last few months and the lower costs of production only now beginning to flow through to producers, prices are still depressingly weak. Right now, points out TD Securities Global Strategist Stephen Koukoulas, the level of commodity prices is similar to, or is even lower than the levels prevailing in the period 1974 to 1977, only 9% above their 35 year low. And if you’re old enough to remember, those weren’t the best of times.

Once it was clear that most commodities were going to be selling at or below production costs, we were left with a situation that made it hard to see how prices could rise any time in the foreseeable future. With too much supply and too little demand, this will take a while to work itself through. Add to that a global recession that makes any type of sustained demand recovery seem like a distant dream and the outlook for commodities and the Australian economy, which are inextricably linked, is less than bullish.

Making matters worse, points out Koukoulas, Australia itself is sitting on a huge capacity excess, which means that business investment will drop sharply over the next 18 to 24 months.

The broadening recession in Australia is unsurprisingly showing up in stock prices, which have now fallen to a level first reached in August 2000. The S&P/ASX200 index is now around 51% below the November 2007 high. Corporate profit outlooks are being slashed as the recession undermines earnings. Koukoulas notes the wealth erosion from this weakness all but ensures an extended period of poor consumer demand and depressed sentiment.

This leads him to think that the AUD is in for even harder times ahead. At present levels of around US$0.65, the currency is just 10c below the long run fair value, yet the traditional drivers of the Aussie have almost never looked worse. This view sees him predict a fall to US$0.58 and lower as the reality of the burst commodity bubble and an inevitable Australian recession begins to be grudgingly accepted.