Commodities | Jul 05 2007

By Greg Peel

For the purpose of this article, all uranium price quotes can be read as US$/lb.

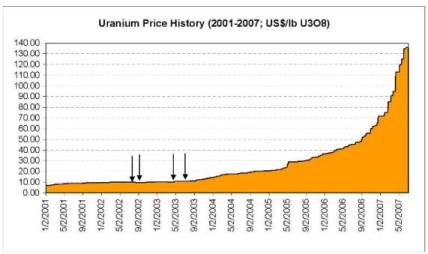

Uranium market speculators are no longer quite as confident. On seemingly a bet to nothing over the past two years, hedge funds and investment vehicles had allegedly increased their investment to around 20% of the known uranium oxide supply as spot prices ticked exponentially only up for 47 months straight to peak at $138 last month. While uranium has not been without company as most of the metal and mineral spectrum has enjoyed spectacular gains, it has been unusual in never having suffered a pullback during its run. Always in sight was the supposed benchmark that reactors could afford uranium up to $200 before nuclear power began to look uncommercial.

But we seem to have reached a stand-off on the road up, manifested by a sudden drop off in interest in buying in the spot market this last month. The spot uranium price has actually fallen to $135 according to two major industry consultants. There are those that believe an inevitable price pullback is upon us as utilities take a back seat and allow wobbly hedge funds to make a move while investment vehicles back off. Perhaps this is the real industry’s way of teaching the cowboys a lesson. Or perhaps a $3 fall is all we’ll see.

It depends who you talk to.

Source: Raymond James

There are however, certain market drivers accepted as fact by the industry. Firstly, demand will outstrip supply for some time yet. Secondly, supply is actually abundant but slow to move so eventually there will be a price pullback, perhaps as much as 50% or more. Beyond that, peak price forecasts range from around $150-175, although Macquarie analysts have famously said they “wouldn’t be surprised” to see $200.

The analysts at Lehman Bros note that as at the end of May there were 437 commercial nuclear power plants operating in 30 countries across the globe, producing 370,040MW of electricity. This represents about 16% of the world’s electricity needs. However, as electricity demand has grown dramatically, nuclear’s share of world supply has remained stable at 16% since 1987. And this is despite today’s reactors being 20% more efficient, and enrichment and reprocessing technology being much more advanced.

In addition to the 437 reactors, 30 more are under construction, 74 have been given approval and 182 more are proposed. Leading the charge are China, Japan, India and Russia. Reactors require the most uranium fuel at inception as the core is fired up. Thereafter about a third to a half of the core needs to be replaced every one to two years. At present core construction requires a lead time on uranium delivery of three years. By 2013 Lehmans forecast this will have stretched to four years.

In 2006, 60% of uranium supply came from mines, of which more than half was sourced from Canada, Australia and Kazakhstan. 35% of supply was provided from dismantled weapons and military and utility stockpiles in the US and Former Soviet Union. The remaining 5% came from reprocessing and re-enrichment – mainly in Europe.

Lehmans assumes global mine output will grow steadily by 3% per annum. The analysts have then added in the eventual start-up of the flooded Cigar Lake in Canada, the tripling of capacity at BHP Billiton’s (BHP) Olympic Dam in South Australia, and a significant increase in production from Kazakhstan. On the other side of the ledger, secondary supply is expected to decline from 25,000t in 2006 to 5,000t by 2020. Reprocessing supply should quietly grow by 0.3% per annum.

In considering what all these inputs mean to the uranium spot price curve, Lehmans makes note that the actual spot market is very illiquid. Transactions of as little as 100,000/lb can shift the price and the much anticipated futures market has proven a failure to date. The behind the scenes reality of the uranium market is that utilities sign up for long term contracts with suppliers. Not much of the world’s uranium trade actually passes through the spot market. The spot price is used as an indicator, but no long term deal will have recently been settled at anything like the prevailing spot.

Contracts are typically settled on “cap and floor” limits in deals over several years. The rise in price has meant the ball is now in the supplier’s court in terms of price-setting, but anecdotal comments from the likes of global newcomer Paladin Resources (PDN) suggest utilities are not prepared to pay up to silly levels. More important in uranium price negotiations are considerations of the “long term” price, not spot.

Thus the scene is aptly set for the spot market to experience a blow-off top, if even for a short period. Realistically, while a few smaller utilities are forced to play the spot market game it will mostly be the investors and speculators meeting at the gym to rumble. The big suppliers and consumers will not need to attend.

One of the two recognised spot price monitors, UxC, made this observation yesterday:

“The downtick however, could be a sign of more weakness to come over the next few months. UxC believes that utilities are less likely to be motivated to purchase on the spot market over the next several months because they have no uncovered needs for the rest of the year and little for the first half of next year. Discretionary purchases by funds are beginning to look increasingly uncertain because limited upside potential is being met with seemingly increasing downside risk. On the sell side, sellers may be increasingly willing to make competitive offers. UxC cites sell pressures such as fiscal year-end, quota issues, cash flow inventory positions, as well as, a softening buying atmosphere.”

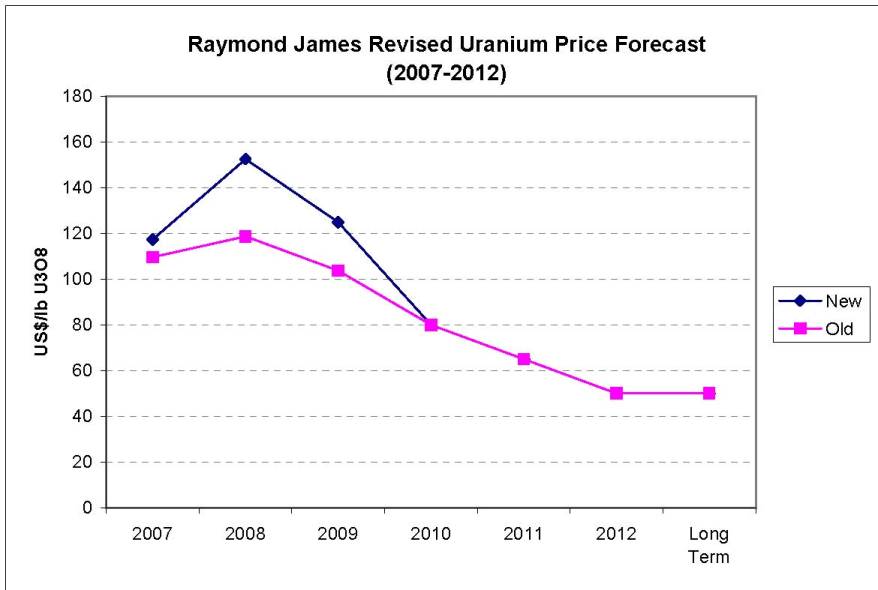

Nevertheless, UxC still sees a higher price in 2008 – $153 to be precise – but that will be the peak. Forecast prices beyond are $125 (2009), $80 (2010), $65 (2011) and $50 (2012).

Canadian brokerage Raymond James is forecasting a largely identical curve. The following graph suggests longer term forecasts remain pretty much intact despite a slightly higher peak price prediction than was previously considered.

More bullish Lehman Bros analysts are pitching for the peak to be reached around early 2009 at $160-175 before an orderly decline commences.

Deutsche Bank analysts recently updated their forecasts quite aggressively, suggesting an average price of $156.30 in 2008 and an average of $175 in 2009 (that’s an average, not a peak). Three months ago Deutsche’s equivalent forecast was $105. However, the analysts see 2010 as crunch year with sudden supply forcing the average to crash to $95.

FNArena tabled several local broker’s forecasts in March, and arrived at a forecast average of $89 for 2008 and $78 for 2009. Contributors were GSJB Were, Macquarie, JP Morgan, Merrill Lynch, ABN Amro, Citi and Deutsche. The highest price anyone came up with was $130, and that was Were’s each-way-bet “high case” scenario. The lowest high was Citi at $73, and for reasons known only to Alan Heap, Citi maintains a 2007 average forecast in the $70s.

What is an investor to make of all of this? Probably that analysts are by their nature reactive rather than proactive. One thing is certain and that is that in three months the world has not suddenly built a whole lot of new reactors out of the blue. If there are any changes in that time its been the flooding of Energy Resources of Australia’s (ERA) Ranger mine and a failure by the Australian Labor party opposition to resolve any national uranium mining policy. (The states are still permitted to make their own call, meaning its a No from Western Australia’s Alan Carpenter and a No from the Queensland coal union through spokesman Peter Beattie. Not even South Australia is a certainty for expansion beyond existing mines at present).

But on the flipside we’ve learnt of some aggressive offshore ramp-up plans from Rio Tinto (RIO) and others. Just about everything else, including Cameco’s soggy Cigar, has been consistent over the period.

The other consistency has been the longer term forecast uranium price, which remains at a consensus $50. This, incidentally, more accurately represents the sort of benchmark the real uranium market players use for their long term contract pricing.

The best uranium sector investors can do at this point is to focus on production rather than price. If the spot price does take a short term dive, then it will be the thin-air explorers and wannabe’s amongst the pack that will find vacuums underneath their share prices. Those with proven reserves may lose some euphoria premium, if they haven’t already, but will then emerge as the solid investments as the demand/supply equation stamps its mark on an otherwise speculative market.