FINANCIAL NEWS

Australian Broker Call *Extra* Edition – Apr 18, 2024

Extra Edition of the Broker Call Report

10:30 AM

Material Matters: Gold, Gold Stocks & Rare Earths

A glance through the latest expert views and predictions about commodities: potential upside as gold stocks bridge the gap to a surging gold price; plus rising rare earths price forecasts

10:00 AM

The Overnight Report: Reality Check

A maker of machines that make AI chips posted a weak earnings result last night, triggering selling in the space. S&P500 down -0.6%. (Available for non-subscribers after 10am)

8:58 AM

ASX Winners And Losers Of Today – 17-04-24

The table inside ranks the 20 biggest percentage winners and losers among stocks in the ASX300 at the end of each trading day

Apr 17 2024

Citi rates BOQ as Sell

Bank of Queensland's 1H cash earnings exceeded prior forecasts of Citi and consensus by 6%, but was arguably a low-quality result driven by lower opex (more costs being capitalised) and lower bad and doubtful debts.

While the broker feels the bottom has been reached for the current earnings contraction cycle, the analysts see uncertainty for the medium-term outlook. Management conceded there was no discernible pathway to the company's FY26 targets, highlight the analysts.

The Sell rating and $5.05 target are maintained.

Bell Potter rates TNE as Buy

When TechnologyOne reports second half earnings in May Bell Potter expects mid-teens earnings growth to mostly be driven by strong top line growth with only a modest improvement in the margin, consistent with the first half result.

The broker expects management to provide its typical guidance of 10-15% profit growth for the full year but believes this is conservative and likely to be exceeded.

The company exceeded guidance in FY23 with profit growth of 16% and Bell Potter currently forecasts growth of 18% in FY24.

Buy and $18.50 target retained.

Click here to see full report

ANALYSIS & DATA

FNARENA'S MARKET CONSENSUS FORECASTS

To display the stock analysis for a company please enter the company code:

ANZ | ANZ GROUP HOLDINGS LIMITED

Abbreviated format - see the full version here

| LAST PRICE | CHANGE +/- | CHANGE % | VOLUME |

|---|---|---|---|

|

$28.37 17 Apr |

OPEN $28.42 |

HIGH $28.63 |

2,677,288 LOW $28.37 |

| TARGET | |||

| $28.022 -1.2% downside | |||

| Franking for last dividend paid out: 56% |

| Title | FY22 Actual |

FY23 Actual |

FY24 Forecast |

FY25 Forecast |

|---|---|---|---|---|

| EPS (cps) | xxx | N/A | 221.7 | xxx |

| DPS (cps) | xxx | N/A | 162.8 | xxx |

| EPS Growth | xxx | N/A | N/A | xxx |

| DPS Growth | xxx | N/A | N/A | xxx |

| PE Ratio | xxx | N/A | 12.9 | xxx |

| Dividend Yield | xxx | N/A | 5.7% | xxx |

| Div Pay Ratio(%) | xxx | N/A | 73.4% | xxx |

DAILY FINANCIAL NEWS

Material Matters: Gold, Gold Stocks & Rare Earths

A glance through the latest expert views and predictions about commodities: potential upside as gold stocks bridge the gap to a surging gold price; plus rising rare earths price forecasts

10:00 AM - Commodities

Wealth platform Hub24 has marked a record March quarter of inflows but will see revenue margins fall from here

Apr 17 2024 - Australia

A glance through the latest expert views and predictions about commodities. Base metal pricing aided by Russian bans along with decarbonisation tailwinds; plus price forecasts for coal and iron ore

Apr 17 2024 - Commodities

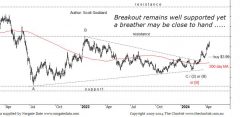

The Chartist reports the trend for the copper price remains to the upside, but a breather is likely soon

Apr 17 2024 - Technicals

Domino’s Pizza’s rapid covid era expansion in Japan has led to difficulties, impacting on store rollout and sales growth plans

Apr 16 2024 - Australia

Michael Gable of Fairmont Equities sees Orica shares pushing past $20 in the months ahead

Apr 16 2024 - Technicals

PR NEWSWIRE

Finmo Introduces Direct Real-Time Payment (RTP) Integration in Australia and Expands Global Team

9:00 AM - PR NewsWire

Australia-China Business Forum Unveils Second International Supply Chain Expo in Sydney

Apr 17 2024 - PR NewsWire

Q1 2024 Revenue and Business Update

Apr 17 2024 - PR NewsWire

TASK signs Sushi Sushi to deliver all-encompassing enterprise solution

Apr 17 2024 - PR NewsWire

Pudu Robotics Releases Catering and Retail Service Robot, BellaBot Pro, With New AI, Safety and Marketing Capabilities

Apr 17 2024 - PR NewsWire

Roborock Launches a Clean Sweep Across Australia and New Zealand with S8 MaxV Ultra Robotic Cleaner

Apr 17 2024 - PR NewsWire

RUDI'S VIEWS

Rudi’s View: Shaky Sentiment Ahead Of Corporate Updates

In this week's Weekly Insights: -Shaky Sentiment Ahead Of Corporate Updates-Everybody's A Gold Bull-Best Buys & Conviction Calls By Rudi…

Apr 17 2024

DAILY MARKET REPORTS

Australian Broker Call *Extra* Edition – Apr 18, 2024

Extra Edition of the Broker Call Report

10:30 AM

The Overnight Report: Reality Check

A maker of machines that make AI chips posted a weak earnings result last night, triggering selling in the space. S&P500 down -0.6%. (Available for non-subscribers after 10am)

8:58 AM

ASX Winners And Losers Of Today – 17-04-24

The table inside ranks the 20 biggest percentage winners and losers among stocks in the ASX300 at the end of each trading day

Apr 17 2024

The Overnight Report: Dead Cat

An attempt at a modest bounce on Wall Street last night failed at the death. S&P500 down -0.2%. (Available for non-subscribers after 10am)

Apr 17 2024

ASX Winners And Losers Of Today – 16-04-24

The table inside ranks the 20 biggest percentage winners and losers among stocks in the ASX300 at the end of each trading day

Apr 16 2024

WEEKLY REPORTS

Weekly Update On LICs & LITs – 16-Apr-2024

Weekly update of Listed Investment Companies (LICs) & Listed Investment Trusts (LITs) on the ASX

Apr 16 2024

Uranium Week: Much To Discuss

Ahead of this week’s global nuclear conference, the uranium spot price ticked higher last week as the SPUT stepped in with buying

Apr 16 2024

Australian Listed Real Estate Tables – 15-04-2024

FNArena provides a weekly update of Australian listed real estate trusts (REIT) and property developers, current pricing yield and valuation data

Apr 15 2024

Weekly Ratings, Targets, Forecast Changes – 12-04-24

Weekly update on stockbroker recommendation, target price, and earnings forecast changes

Apr 15 2024

In Case You Missed It – BC Extra Upgrades & Downgrades – 12-04-24

A summary of the highlights from Broker Call Extra updates throughout the week past

Apr 12 2024

Weekly Top Ten News Stories – 12 April 2024

Our top ten news stories from 04 April 2024 to 11 April 2024

Apr 12 2024

Next Week At A Glance – 15-19 Apr 2024

A brief look at important company events and economic data releases next week

Apr 12 2024

In Brief: Pro Medicus, Trump’s Trade War & Resi Construction

Weekly Broker Wrap: aggressive new target price for Pro Medicus; fears of a new Trump-inspired trade war; the best REITs for falling interest rates; and lagging starts figures for residential construction

Apr 12 2024

The Short Report – 11 Apr 2024

FNArena’s weekly update on short positions in the Australian share market

Apr 11 2024

THE MARKETS

Click item/line to change chart

FNARENA WINDOWS

Window on MINING

Material Matters: Gold, Gold Stocks & Rare Earths

A glance through the latest expert views and predictions about commodities: potential upside as gold stocks bridge the gap to a surging gold price; plus rising rare earths price forecasts

10:00 AM

Window on WEALTH MANAGEMENT & INVESTMENTS

Award-Winning Hub24

Wealth platform Hub24 has marked a record March quarter of inflows but will see revenue margins fall from here

Apr 17 2024

Window on MINING

Material Matters: Base Metals, Coal & Iron Ore

A glance through the latest expert views and predictions about commodities. Base metal pricing aided by Russian bans along with decarbonisation tailwinds; plus price forecasts for coal and iron ore

Apr 17 2024

SMSFUNDAMENTALS

SMSFundamentals: Inflation Beats Covid, Markets As Retirement Influencer

Australians have become less comfortable with their plans for retirement, and inflation is to blame

Nov 29 2023

0.010

0.010