FINANCIAL NEWS

ASX Winners And Losers Of Today – 19-04-24

The table inside ranks the 20 biggest percentage winners and losers among stocks in the ASX300 at the end of each trading day

6:35 PM

FNArena Corporate Results Monitor – 19-04-2024

FNArena’s Monitor keeps track of corporate earnings result releases, including broker views, ratings and target price changes and beat/miss assessments

11:15 AM

In Case You Missed It – BC Extra Upgrades & Downgrades – 19-04-24

A summary of the highlights from Broker Call Extra updates throughout the week past

10:50 AM

Weekly Top Ten News Stories – 19 April 2024

Our top ten news stories from 11 April 2024 to 18 April 2024

10:40 AM

Next Week At A Glance – 22-26 Apr 2024

A brief look at important company events and economic data releases next week

10:20 AM

Macquarie rates BGL as Downgrade to Neutral from Outperform

While Bellevue Gold's third quarter production of 37,300 ounces of gold left Macquarie a little disappointed, the broker remains optimistic that strong development grades in March bode well for the fourth quarter.

The broker now assumes a long-term mining and milling rate of 1.2m tonnes per annum, subsequently lifting the long-term production outlook by 9%.

The broker looks forward to FY25 guidance for a better indication of Bellevue Gold's long-term cost base.

The rating is downgraded to Neutral from Outperform and the target price increases to $2.00 from $1.90.

Bell Potter rates PMV as Reinitiate coverage with Buy

Premier Investments is currently trading on 14x forecast FY26 PE on Bell Potter's estimates.

The broker thinks the multiple is conservative given the value emerging from the potential demerger of two key brands, Smiggle and Peter Alexander, which Bell Potter believes are "global roll-out" worthy, and highly profitable.

As the Smiggle brand looks to grow its presence in the Middle East and Indonesia via a low-risk wholesale model and Peter Alexander into the UK, the broker suggests the two brands have a long runway ahead.

Bell Potter re-initiates coverage with Buy and a $35 target.

Morgan Stanley rates STO as Equal-weight

March quarter production for Santos missed forecasts by Morgan Stanley and consensus by -2% and -3%, respectively, due to both planned and unplanned outages. A muted share price reaction to the result is anticipated.

The broker assesses good overall production and sales for the quarter, and highlights Barossa is 70.6% complete with first gas still targeted for the 3Q of FY25.

The Equal-weight rating and $8.00 target are maintained. Industry view: Attractive.

Click here to see full report

ANALYSIS & DATA

FNARENA'S MARKET CONSENSUS FORECASTS

To display the stock analysis for a company please enter the company code:

BHP | BHP GROUP LIMITED

Abbreviated format - see the full version here

| LAST PRICE | CHANGE +/- | CHANGE % | VOLUME |

|---|---|---|---|

|

$45.09 18 Apr |

OPEN $44.93 |

HIGH $45.42 |

8,702,905 LOW $44.90 |

| TARGET | |||

| $45.133 0.1% upside | |||

| Franking for last dividend paid out: 100% |

| Title | FY24 Forecast |

FY25 Forecast |

|---|---|---|

| EPS (cps) | 405.9 | xxx |

| DPS (cps) | 231.0 | xxx |

| EPS Growth | N/A | xxx |

| DPS Growth | N/A | xxx |

| PE Ratio | 11.0 | xxx |

| Dividend Yield | 5.2% | xxx |

| Div Pay Ratio(%) | 56.9% | xxx |

DAILY FINANCIAL NEWS

FNArena Corporate Results Monitor – 19-04-2024

FNArena’s Monitor keeps track of corporate earnings result releases, including broker views, ratings and target price changes and beat/miss assessments

11:15 AM - Australia

Bank of Queensland’s result beat forecasts but brokers claim low quality, and line up to retain Sell ratings

Apr 18 2024 - Australia

A glance through the latest expert views and predictions about commodities: potential upside as gold stocks bridge the gap to a surging gold price; plus rising rare earths price forecasts

Apr 18 2024 - Commodities

Wealth platform Hub24 has marked a record March quarter of inflows but will see revenue margins fall from here

Apr 17 2024 - Australia

A glance through the latest expert views and predictions about commodities. Base metal pricing aided by Russian bans along with decarbonisation tailwinds; plus price forecasts for coal and iron ore

Apr 17 2024 - Commodities

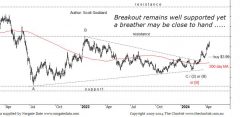

The Chartist reports the trend for the copper price remains to the upside, but a breather is likely soon

Apr 17 2024 - Technicals

PR NEWSWIRE

Hyundai Capital continues global expansion with new entities in Asia Pacific

10:00 AM - PR NewsWire

Moomoo and Nasdaq Celebrate Six-Year Partnership and Announce a Global Strategic Partnership to Continue Promoting Investor Education

8:00 AM - PR NewsWire

2024 Appian Innovation Award Winners Demonstrate Significant Business Results with Next-Gen AI Process Automation

Apr 18 2024 - PR NewsWire

Bybit Card Collaborates with International eSIM Provider Airalo, Bringing Seamless Connectivity to the EEA Region and Australia

Apr 18 2024 - PR NewsWire

Mini brains and lab-on-a-chip wearables: Jumar Bioincubator officially begins its mission to build “Australia’s next CSL”

Apr 18 2024 - PR NewsWire

Finmo Introduces Direct Real-Time Payment (RTP) Integration in Australia and Expands Global Team

Apr 18 2024 - PR NewsWire

RUDI'S VIEWS

Rudi’s View: Shaky Sentiment Ahead Of Corporate Updates

In this week's Weekly Insights: -Shaky Sentiment Ahead Of Corporate Updates-Everybody's A Gold Bull-Best Buys & Conviction Calls By Rudi…

Apr 17 2024

DAILY MARKET REPORTS

ASX Winners And Losers Of Today – 19-04-24

The table inside ranks the 20 biggest percentage winners and losers among stocks in the ASX300 at the end of each trading day

6:35 PM

The Overnight Report: Loser

Down -0.2% last night, the S&P500 has now posted its longest losing streak since October. (Available for non-subscribers after 10am)

9:00 AM

ASX Winners And Losers Of Today – 18-04-24

The table inside ranks the 20 biggest percentage winners and losers among stocks in the ASX300 at the end of each trading day

Apr 18 2024

Australian Broker Call *Extra* Edition – Apr 18, 2024

Extra Edition of the Broker Call Report

Apr 18 2024

The Overnight Report: Reality Check

A maker of machines that make AI chips posted a weak earnings result last night, triggering selling in the space. S&P500 down -0.6%. (Available for non-subscribers after 10am)

Apr 18 2024

WEEKLY REPORTS

In Case You Missed It – BC Extra Upgrades & Downgrades – 19-04-24

A summary of the highlights from Broker Call Extra updates throughout the week past

10:50 AM

Weekly Top Ten News Stories – 19 April 2024

Our top ten news stories from 11 April 2024 to 18 April 2024

10:40 AM

Next Week At A Glance – 22-26 Apr 2024

A brief look at important company events and economic data releases next week

10:20 AM

In Brief: Made In Australia, Insurance & Groceries

Weekly Broker Wrap: beneficiaries of the Future Made in Australia Act; rising excesses for general insurers; plus impacts of grocery market inquiry

10:00 AM

The Short Report – 18 Apr 2024

FNArena’s weekly update on short positions in the Australian share market

Apr 18 2024

Weekly Update On LICs & LITs – 16-Apr-2024

Weekly update of Listed Investment Companies (LICs) & Listed Investment Trusts (LITs) on the ASX

Apr 16 2024

Uranium Week: Much To Discuss

Ahead of this week’s global nuclear conference, the uranium spot price ticked higher last week as the SPUT stepped in with buying

Apr 16 2024

Australian Listed Real Estate Tables – 15-04-2024

FNArena provides a weekly update of Australian listed real estate trusts (REIT) and property developers, current pricing yield and valuation data

Apr 15 2024

Weekly Ratings, Targets, Forecast Changes – 12-04-24

Weekly update on stockbroker recommendation, target price, and earnings forecast changes

Apr 15 2024

THE MARKETS

Click item/line to change chart

FNARENA WINDOWS

Window on BANKS

Bank of Queensland: Beautiful One Day

Bank of Queensland’s result beat forecasts but brokers claim low quality, and line up to retain Sell ratings

Apr 18 2024

Window on MINING

Material Matters: Gold, Gold Stocks & Rare Earths

A glance through the latest expert views and predictions about commodities: potential upside as gold stocks bridge the gap to a surging gold price; plus rising rare earths price forecasts

Apr 18 2024

Window on WEALTH MANAGEMENT & INVESTMENTS

Award-Winning Hub24

Wealth platform Hub24 has marked a record March quarter of inflows but will see revenue margins fall from here

Apr 17 2024

SMSFUNDAMENTALS

SMSFundamentals: Inflation Beats Covid, Markets As Retirement Influencer

Australians have become less comfortable with their plans for retirement, and inflation is to blame

Nov 29 2023

0.650

0.650